At ValidExamDumps, we consistently monitor updates to the CIMAPRO19-P02-1 exam questions by CIMA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CIMA P2 Advanced Management Accounting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CIMA in their CIMAPRO19-P02-1 exam. These outdated questions lead to customers failing their CIMA P2 Advanced Management Accounting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CIMAPRO19-P02-1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

A group consists of two divisions, Alpha and Beta, both of which are profit centers. Alpha sells a product to the external market and also sells it as an intermediate product to Beta.

Beta then processes further before selling the final product to the external market. The current group transfer pricing policy requires Alpha to charge Beta with the variable cost of production.

Which of the following statements is valid?

An 80% learning curve will apply to the production of a new product. The first unit will require 120 labor hours. The labor rate is $11 per hour.

To the nearest $1, the expected total labor cost for the first 4 units is:

Endure Co. makes 1,000 units ofX and 2,000 units of Y.

Costs for X: Material $4, labour $8, direct overhead $2, fixed cost $4.

Costs for Y: Material $9, labour $9, direct overhead $4, fixed cost $6.

Selling price for X and Y are S19 and $25 respectively. Another company can sell ready made product X and product Y's to Endure Co, this company sells X at $12 and Y at $21. Advise Endure Co. on what would be the

most cost effective way to source products X and Y.

Oliver owns a computer repair company. He is looking to close of of his departments as the demand for computer cleaning has dropped dramatically in the last 2 years and is no longer profitable.

The contribution margin of the department is 12,000, and the overheads are 23,000 (out of which 4,000 cannot be eliminated).

How would closing this department impact operating income?

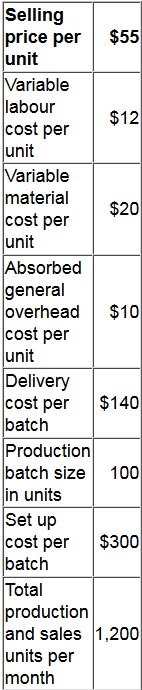

A large manufacturing company sells a range of products. Details of one of these products are as follows.

Each completed batch is delivered immediately in full to the one customer that purchases this product. The delivery vehicle is currently only 50% full when it makes these deliveries. The customer will accept deliveries of any size.

Managers are considering changing the production batch size to 150 units.

Increased material storage would be needed; this can be rented nearby at a cost of $1,500 per month.

The additional storage facility would enable an increase in the reorder quantity for the materials. As a result a 5% discount would be received on all materials purchased.

Using direct product profitability (DPP), what will be the monthly profit attributable to the product if the production batch size is changed to 150 units?

Give your answer to the nearest whole $.