At ValidExamDumps, we consistently monitor updates to the CIMAPRO19-P01-1 exam questions by CIMA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CIMA P1 Management Accounting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CIMA in their CIMAPRO19-P01-1 exam. These outdated questions lead to customers failing their CIMA P1 Management Accounting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CIMAPRO19-P01-1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

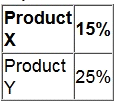

XY sells two products for which the budgeted contribution to sales ratios are as follows:

Total budgeted sales revenue is $920,000, of which $368,000 will be generated by product X. The products must be sold in a constant mix.

Budgeted fixed costs are $105,000.

What is the budgeted breakeven sales revenue?

Give your answer to the nearest $.

A company uses a standard costing system.

The company's sales budget for the latest period includes 1,500 units of a product with a selling price of $400 per unit.

The product has a budgeted contribution to sales ratio of 30%.

Actual sales for the period were 1,630 units at a selling price of $390 per unit.

The actual contribution to sales ratio was 28%.

The sales volume contribution variance for the product for the latest period is:

References:

A manager in your organisation says, "I have spare capacity and I need a unit cost as a basis for pricing a special one-off contract. You have provided me with a relevant cost of $6.50 per unit and a full production cost of $8.00 per unit. Please explain which unit cost I should use."

Which cost should be used in this decision and why?

Select the benefits to a company of using sensitivity analysis in investment appraisal.

(Select all the true statements.)

References: