At ValidExamDumps, we consistently monitor updates to the CIMAPRA19-F02-1 exam questions by CIMA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CIMA F2 Advanced Financial Reporting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CIMA in their CIMAPRA19-F02-1 exam. These outdated questions lead to customers failing their CIMA F2 Advanced Financial Reporting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CIMAPRA19-F02-1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

WX acquired60% of theequitysharesof CD on 1 January 20X3. WX sold5% of the equityshares it heldfor $60,000on 31 December 20X5. At that datethe net assetsof CD were $120,000and thefair value of the non-controlling interestin CDwas measured at$21,000.No goodwill arose on the original acquisition of CD.

When preparing its consoldiated financial statements, WX will process which of the following adjustments to its group retained earnings?

Which THREE of the followingwould typically indicate a finance lease?

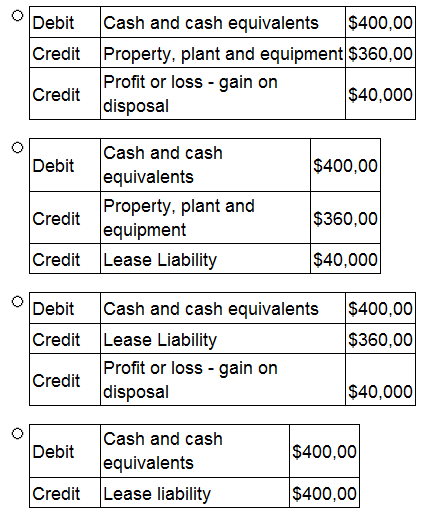

ST has sold its main office property, which had a carrying value of $360,000,to AB, a property management entity.

The property was sold for $400,000 which isequal to itsfair value and was immediately leased back under an operating lease agreement.

Which of the following journals will record this transaction?

Which of the followingreduce the usefulnessof ratio analysis when comparing entities that operate in the same industry? Select ALL that apply.

GH owned 70% of the equity share capital of XY at 1 January 20X6. GH acquired a further 20% of XY's equity share capital on 31 December 20X6 for $430,000. Non controlling interest was measured at $600,000 immediately prior to the 20% acquisition.

Which of the following amounts will GH debit to non controlling interest when the 20% acquisition is adjusted for in its consolidated financial statements at 31 December 20X6?