At ValidExamDumps, we consistently monitor updates to the CIMAPRA17-BA2-1 exam questions by CIMA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the CIMA BA2 - Fundamentals of Management Accounting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by CIMA in their CIMAPRA17-BA2-1 exam. These outdated questions lead to customers failing their CIMA BA2 - Fundamentals of Management Accounting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the CIMAPRA17-BA2-1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

Budgets are produced:

(a) For planning purposes

(b) For control purposes

(c) To be published with the annual accounts

(d) To comply with international accounting standards

A company's policy is to hold closing inventory each month equal to 10% of the next month's budgeted sales volume. The budgeted sales volumes of product Q for months 1 and 2 are 1,660 units and 2,300 units respectively.

The production budget for product Q for month 1 is:

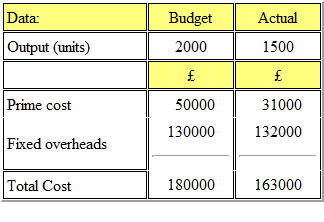

Refer to the exhibit.

A company issued its production budget based on an anticipated output of 2000 units. The actual output for the period was 1500 units. The details of the costs are shown below:

What was the budget expenditure variance?

Zelts Ltd earns a contribution of 20% of the selling price for product 'Y'. The annual fixed costs are 200,000.

In order to earn an annual profit of 100,000 the sales revenue needs to be: