At ValidExamDumps, we consistently monitor updates to the AIWMI CCRA-L2 exam questions by AIWMI. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the AIWMI Certified Credit Research Analyst - Level 2 exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by AIWMI in their AIWMI CCRA-L2 exam. These outdated questions lead to customers failing their AIWMI Certified Credit Research Analyst - Level 2 exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the AIWMI CCRA-L2 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

The following information pertains to bonds:

Further following information is available about a particular bond 'Bond F'

There is a 10.25% risky bond with a maturity of 2.25% year(s) its current price is INR105.31, which corresponds to YTM of 9.22%. The following are the benchmark YTMs.

From the time January 2013 to April 2013, what can you predict about the market conditions, assuming the GSec has not changed?

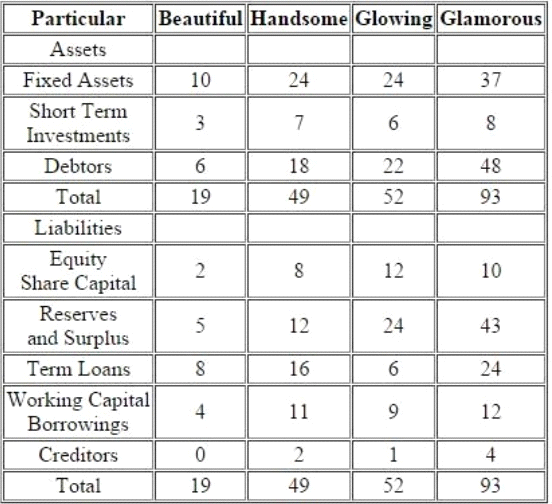

''Following four entities operate in the Indian IT and BPO space. They all are into same segment of providing off-shore analytical services. They all operate on the labour cost-arbitrage in India and the countries of their clients. Following information pertains for the year ended March 31, 2013.

The year FY13, was typically a good year for Indian IT companies. For FY14, the economic analysts have given following predictions about the IT Industry:

A) It is expected that INR will appreciate sharply against other USD.

B) Given high inflation and attrition in IT Industry in India, the wages of IT sector employees will increase more sharply than Inflation and general wage rise in country.

C) US Congress will be passing a bill which restricts the outsourcing to third world countries like India.While analyzing the four entities, you come across following findings related to Glowing:

Glowing is promoted by Mr.M R Bhutta, who has earlier promoted two other business ventures, He started with ABC Entertainment Ltd in 1996 and was promoter and MD of the company. ABC was a listed entity and its share price had sharp movements at the time of stock market scam in late 1990s. In 1999, Mr.Bhutta sold his entire stake and resigned from the post of MD. The stock price declined by about 90% in coming days and has never recovered. Later on in 2003, Mr.Bhutta again promoted a new business, Klear Publications Ltd (KCL) an in the business of magazine publication. The entity had come out with a successful IPO and raised money from public. Thereafter it ran into troubles and reported losses. In 2009, Mr.Bhutta went on to exit this business as well by selling stake to other promoter(s). There have been reports in both instances with allegations that promoters have siphoned off money from listed entities to other group entities, however, nothing has been proved in any court.''

Based solely on Total Debt to EBITDA and Interest Coverage, which of the four entities is best amongst the four respectively:

Proportion of fee based income is examined as the same is an _____ efficient source of bank's profitability.

Following is information related banks:

Auckland Ltd is a public sector bank operating with about 120 branches across Indi

a. The bank has been in business since 1971 and has about 40% branches in rural areas and about 75% of all branches are in

Western India. On the basis of the size, Auckland Ltd will be ranked at number 31 amongst 40 banks in India.

Although top management has appointment period of 5 years, generally they retire on ach sieving age of 60 years with an average tenure of only 2 years at the top job.

Profit and Loss Account

Balance Sheet

The rating wise break-up of assets for FY11 is as follows:

The ROTA for Auckland deteriorated from ___in FY12 to___ in FY13.