At ValidExamDumps, we consistently monitor updates to the AICPA CPA-Regulation exam questions by AICPA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the AICPA CPA Regulation exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by AICPA in their AICPA CPA-Regulation exam. These outdated questions lead to customers failing their AICPA CPA Regulation exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the AICPA CPA-Regulation exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

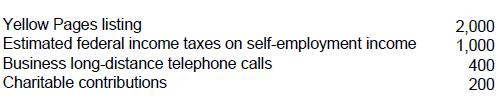

Rich is a cash basis self-employed air-conditioning repairman with 1993 gross business receipts of $20,000. Rich's cash disbursements were as follows:

What amount should Rich report as net self-employment income?

Choice 'a' is correct. Deductions to arrive at net self-employed income include all necessary and ordinary expenses connected with the business. Estimated federal income tax payments are not an expense. Charitable contributions by an individual are only deductible as an itemized deduction on Schedule A. This assumes the contribution was not made with the 'expectation of commensurate financial return.'

Choice 'b' is incorrect. Charitable contributions are an itemized deduction unless there is an expectation of commensurate financial return.

Choice 'c' is incorrect. Federal income taxes paid are not a deductible expense.

Choice 'd' is incorrect. Charitable contributions are an itemized deduction unless there is an expectation of commensurate financial return. Federal income taxes paid are not a deductible expense.

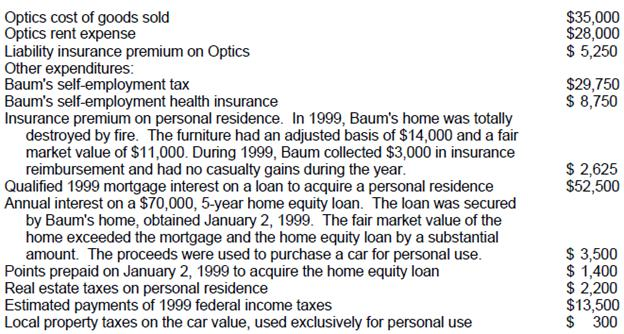

Baum, an unmarried optometrist and sole proprietor of Optics, buys and maintains a supply of eyeglasses and frames to sell in the ordinary course of business. In 1999, Optics had $350,000 in gross business receipts and its year-end inventory was not subject to the uniform capitalization rules. Baum's 1999 adjusted gross income was $90,000 and Baum qualified to itemize deductions. During 1999, Baum recorded the following information:

Business expenses:

What amount should Baum report as 1999 net earnings from self-employment?

Choice 'd' is correct. Baum should report $281,750 as 1999 net earnings from self-employment (line 12 of the Form 1040), calculated as follows:

Choices 'a', 'b', and 'c' are incorrect. Self-employment tax and self-employment health insurance expenses are adjustments from total gross income. They are not deducted from self-employment earnings (i.e., not reported net on line 12 of the Form 1040).

Note: There are many distracters in this question, all relating to items that are either deductible as part of itemized deductions or not deductible. Be careful to read the requirement of the question before spending unnecessary time on the question. The statement that Baum's year-end inventory was not subject to the uniform capitalization rules is a distracter as well. There is not enough information given in the facts to apply the rules if he had been subject to them.

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income. During 1994, Tom's daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom's dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores' 1994 Form 1040.

The Moores received a stock dividend in 1994 from Ace Corp. They had the option to receive either cash or Ace stock with a fair market value of $900 as of the date of distribution. The par value of the stock was $500.

'C' is correct. $900. If a taxpayer has the option of taking a dividend either in stock or in other property (e.g., cash), the dividend is taxable regardless of the option the taxpayer selects.

Fred Berk bought a plot of land with a cash payment of $40,000 and a mortgage of $50,000. In addition, Berk paid $200 for a title insurance policy. Berk's basis in this land is:

Choice 'd' is correct. $90,200 is Berk's basis in the land.

Rule: The basis of the property acquired will be the property's cost consisting of the amount of cash paid plus any amount of related debt assumed. Cost will be adjusted to reflect any additional costs incurred in purchasing the property.

Choices 'a', 'b', and 'c' are incorrect, per the above rule.

Conner purchased 300 shares of Zinco stock for $30,000 in 1980. On May 23, 1994, Conner sold all the stock to his daughter Alice for $20,000, its then fair market value. Conner realized no other gain or loss during 1994. On July 26, 1994, Alice sold the 300 shares of Zinco for $25,000.

What amount of the loss from the sale of Zinco stock can Conner deduct in 1994?

Choice 'a' is correct. Even though Conner has a realized loss of $10,000 on this transaction he cannot deduct the loss since it was incurred in a transaction with his daughter, a related party.

Choice 'b' is incorrect. $3,000 is the limit on deductible net capital losses. However, Conner cannot deduct this loss, since it was incurred in a transaction with his daughter, a related party.

Choice 'c' is incorrect. Conner's realized loss on the sale is $10,000 ($20,000 proceeds less $30,000 basis). However, Conner cannot deduct this loss, since it was incurred in a transaction with his daughter, a related party.

Choice 'd' is incorrect. $10,000 is Conner's realized loss on the sale. However, Conner cannot deduct this loss, since it was incurred in a transaction with his daughter, a related party.