At ValidExamDumps, we consistently monitor updates to the AICPA CPA-Financial exam questions by AICPA. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the AICPA CPA Financial Accounting and Reporting exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by AICPA in their AICPA CPA-Financial exam. These outdated questions lead to customers failing their AICPA CPA Financial Accounting and Reporting exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the AICPA CPA-Financial exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

On January 1, 20X1, Pell Corp. purchased a machine having an estimated useful life of 10 years and no salvage. The machine was depreciated by the double declining balance method for both financial statement and income tax reporting. On January 1, 20X6, Pell changed to the straight-line method for financial statement reporting but not for income tax reporting. Accumulated depreciation at December 31, 20X5, was $560,000. If the straight-line method had been used, the accumulated depreciation at December 31, 20X5, would have been $420,000. Pell's enacted income tax rate for 20X6 and thereafter is 30%. The amount shown in the 20X6 income statement for the cumulative effect of changing to the straight-line method should be:

Choice 'd' is correct. A change in the method of depreciation is now considered to be both a change in method and a change in estimate. These changes should be accounted for as changes in estimate and handled prospectively. The new depreciation method should be used as of the beginning of the year of change and should start with the current book value of the underlying asset. No retroactive or retrospective calculations should be made, and no adjustment should be made to retained earnings.

And, certainly, the cumulative effect should not be reflected on the income statement any more.

Choices 'a', 'b', and 'c' are incorrect, per the above Explanation: .

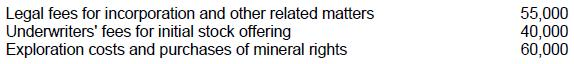

Tanker Oil Co., a development stage enterprise, incurred the following costs during its first year of operations:

Tanker had no revenue during its first year of operation. What amount may Tanker capitalize as organizational costs?

Choice 'd' is correct. $0.

All organizational costs (start-up costs) should be expensed when incurred (per SOP 98-5).

Fair Value Measurements

Lore Co. changed from the cash basis of accounting to the accrual basis of accounting during 1994. The cumulative effect of this change should be reported in Lore's 1994 financial statements as a:

Choice 'a' is correct. The cash basis for financial reporting is not a generally accepted accounting basis of accounting (GAAP); therefore, it is an error. Correction of an error from a prior period is a reported as prior period adjustment to retained earnings.

Choice 'b' is incorrect. Cash basis reporting is not an accounting principle under accrual accounting principles. Thus, the change from cash basis is not reported as a change in accounting principle. In addition, changes in accounting principle are not prior period adjustments; instead, they are treated retrospectively.

Choices 'c' and 'd' are incorrect. Correction of prior period errors has no effect on the current year's income statement.

Which of the following describes how comprehensive income should be reported?

Choice 'c' is correct.

Comprehensive income must be presented in one of three formats:

1. In a combined statement of income and comprehensive income;

2. In a separate statement of comprehensive income that begins with net income; or

3. In a statement of changes in equity.

Choices 'a', 'b', and 'd' are incorrect, per the above.

Balance Sheet and Disclosures Overview

According to the FASB conceptual framework, which of the following situations violates the concept of reliability?

Choice 'd' is correct. Management's estimate of market value lacks verifiability, which is a component of reliability. SFAC 2 para. 89

Choice 'a' is incorrect. Communicating data on segments to analysts does not violate the concept of reliability.

Choice 'b' is incorrect. Issuing financial statements nine months late violates timeliness, which is a component of relevance, not reliability. SFAC 2 para. 56

Choice 'c' is incorrect. Neglecting to report results of new projects violates full disclosure, not reliability.