At ValidExamDumps, we consistently monitor updates to the AAFM GLO_CWM_LVL_1 exam questions by AAFM. Whenever our team identifies changes in the exam questions,exam objectives, exam focus areas or in exam requirements, We immediately update our exam questions for both PDF and online practice exams. This commitment ensures our customers always have access to the most current and accurate questions. By preparing with these actual questions, our customers can successfully pass the AAFM Chartered Wealth Manager (CWM) Global Examination exam on their first attempt without needing additional materials or study guides.

Other certification materials providers often include outdated or removed questions by AAFM in their AAFM GLO_CWM_LVL_1 exam. These outdated questions lead to customers failing their AAFM Chartered Wealth Manager (CWM) Global Examination exam. In contrast, we ensure our questions bank includes only precise and up-to-date questions, guaranteeing their presence in your actual exam. Our main priority is your success in the AAFM GLO_CWM_LVL_1 exam, not profiting from selling obsolete exam questions in PDF or Online Practice Test.

A will that can only be made by a soldiers in actual warfare, or airmmen or mariners at sea is known as:

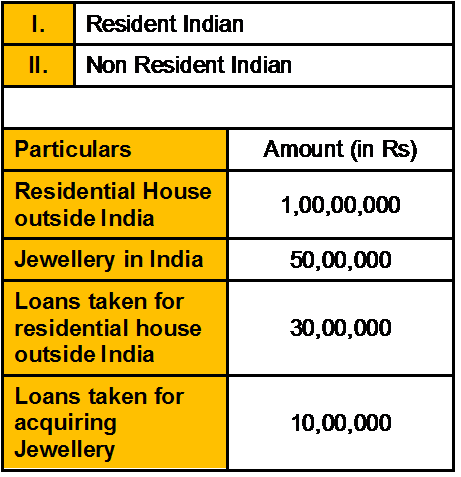

From the following information of assets assets and liabilities, the taxable wealth for:

A portfolio manager is considering buying Rs. 1,00,000 worth of Treasury bills for Rs. 96,211 versus Rs. 100,000 worth of commercial paper for Rs. 95,897. Both securities will mature in nine months. How much additional return will the commercial paper generate over the Treasury bills?

Which of the following is a reasonable assumption to make about the understanding of a client on the Wealth planning Process?

Compute Geometric mean return for an investment with the following per period return -- 8.9%, 10%, 7.7%, 13%?